ABOUT US

NREAM has adopted all seven principles and the supplementary principles of the Principles for Customer-Oriented Business Conduct, published by the Financial Services Agency on March 30, 2017, and revised on January 15, 2021, and September 26, 2024, and has established the Policy on Investor-Oriented Business Conduct.

To ensure fiduciary duty to investors is applied in practice, NREAM will continually monitor progress, and where necessary, review its Policy Regarding Fiduciary Duty to Investors.

As a financial business operator, NREAM will work in the best interests of investors by maintaining the high standards of expertise and ethical behavior and by providing honest and fair advice.

NREAM will also strive to make fiduciary duty an integral part of its corporate culture.

To pursue the best interests of investors in the provision of asset management and other services, NREAM maximizes the expertise and network of the Nomura Real Estate Group. As part of that relationship, NREAM sells and purchases assets, carries out subcontracted business activities, and conducts other business transactions with related parties in the Nomura Real Estate Group and other partners, creating the potential for conflicts of interest with investors. Furthermore, NREAM has been entrusted with the management of several investment funds, which may create potential conflicts of interest with investors.

NREAM is well aware of this aspect of its business and is committed to retaining investor confidence by implementing systems to manage potential conflicts of interest appropriately.

NREAM will work to disclose more information to provide investors with a better understanding of its products and services, including detailed information regarding commissions and charges such as asset management fees paid by investors, as required by law, and information disclosed voluntarily by the Company.

NREAM has been entrusted to carry out all asset management-related services for Nomura Real Estate Master Fund, Inc. (NMF). Asset management fees received for those services are explained in an easy-to-understand manner on NMF's website.

To ensure investor understanding, NREAM will diligently provide easy-to-understand information about the funds it has been entrusted to manage and other financial products and services.

Important information related to the operation of NMF is disclosed in a timely and understandable manner on NMF's website.

NREAM is committed to understanding investors' needs so it can develop products and services and manage assets accordingly.

In providing products and services, NREAM is committed to working in cooperation with internal and external parties involved in product and service structuring, while appropriately accounting for the risks and complexity of each product or service, as well as investor characteristics.

* Currently, NREAM does not sell or recommend packages comprising multiple financial products and services.

To ensure employees pursue the best interests of investors and to appropriately manage conflicts of interest, NREAM is raising awareness about compliance and establishing an investment management approach that puts fiduciary duty.

Specifically, in principle, NREAM develops a compliance program each year, and based on that program, implements compliance training and other measures to raise awareness about compliance.

As part of efforts to thoroughly establish a compliance mindset, NREAM has also developed a Compliance Manual for all employees and executives containing concrete advice about how to put compliance into practice.

In entrusted fund management, NREAM strives to conduct asset management that puts even greater emphasis on returns for investors.

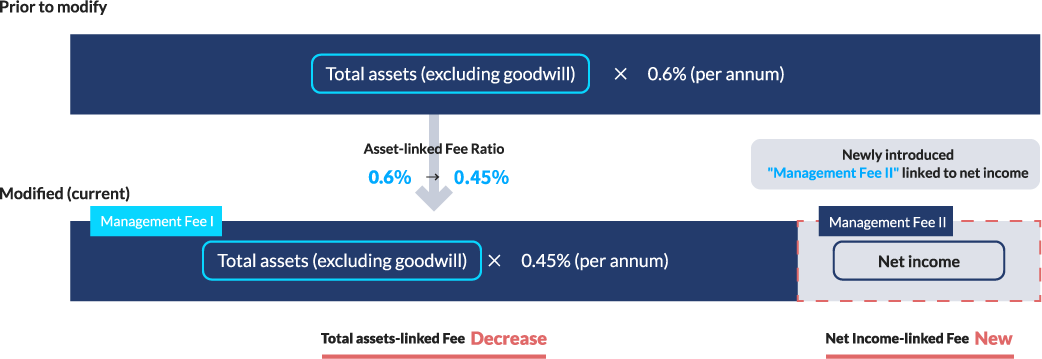

Specifically, NMF revised its asset management fee structure in September 2017, creating a closer link between fees and investor returns. These changes to fee structure are designed to motivate employees to pursue the best interests of investors.

Enacted March 15, 2018

Revised June 24, 2021

Revised December 18, 2025

■ Purpose Values

Click here for details on our raison d'etre and our core Purpose Values.

■ Sustainability

Recognizing that it is essential to consider Environment, Society, and Governance to enhance medium- to long-term value for investors, NREAM has established its basic policy concerning sustainability and is advancing initiatives based on this. See here for NREAM's initiatives related to sustainability.

Also, see here for initiatives related to sustainability in Nomura Real Estate Master Fund, Inc. (NMF), for which NREAM has been entrusted to carry out asset management-related services.

■ High-level Expertise

Officers and employees of NREAM, in principle, comprise personnel loaned from Nomura Real Estate Development Co., Ltd. and include numerous professionals in the real estate field who are endowed with work experience in various departments of the company (such as land acquisition, tenant leasing, development, property management, buying and selling, and mediation). See here for our operating capabilities that are based on NREAM's high-level expertise.

In addition, NREAM encourages all employees (*excluding some officers, contract employees, and assigned employees) to acquire specialist qualifications, such as "Real Estate Transaction Agent" and "Association for Real Estate Securitization Certified Master," as part of its human resources development geared to improving the knowledge and expertise of personnel. NREAM bears the expenses that are incurred in receiving such education, taking examinations, and maintaining qualifications.

* You can scroll to the left and right.

| Professional qualifications | Fiscal 2022 172 executives and employees ※as of July 1, 2022 |

Fiscal 2023 174 executives and employees ※as of July 1, 2023 |

Fiscal 2024 174 executives and employees ※as of July 1, 2024 |

|||

|---|---|---|---|---|---|---|

| Qualification holders * | Percentage | Qualification holders * | Percentage | Qualification holders * | Percentage | |

| Real Estate Transaction Agent | 141 | 82.0% | 149 | 85.63% | 151 | 86.78% |

| ARES Certified Master (ACM) | 107 | 62.2% | 98 | 56.32% | 89 | 51.15% |

| Certified Building Administrator (CBA) | 22 | 12.8% | 21 | 12.07% | 19 | 10.92% |

| Chartered Member of the Securities Analysts Association of Japan (CMA) | 8 | 4.7% | 8 | 4.60% | 6 | 3.45% |

| Real Estate Consulting Master | 8 | 4.7% | 8 | 4.60% | 8 | 4.60% |

| First-class Architect | 7 | 4.1% | 7 | 4.02% | 6 | 3.45% |

| Real Estate Appraiser | 3 | 1.7% | 4 | 2.30% | 4 | 2.30% |

| Licensed Strata Management Consultant | 1 | 0.6% | 1 | 0.57% | 1 | 0.57% |

| Licensed Representative of Condominium Management Company | 1 | 0.6% | 1 | 0.57% | 2 | 1.15% |

| Certified Shopping Center business Administrator (SCBA) | 1 | 0.6% | 1 | 0.57% | 1 | 0.57% |

* Including those who passed the test.

■ High Professional Ethics

NREAM engages in operations with a high standard of professional ethics including the following duties that are required in experts entrusted with real estate-related asset management. Moreover, we seek to penetrate the professional ethics that we adhere to through implementing regular in-company training.

○ Duty of fairness and integrity (Financial Instruments and Exchange Act, Article 36 Paragraph 1)

○ Duty of loyalty (Financial Instruments and Exchange Act, Article 41 Paragraph 1, Article 42 Paragraph 1)

○ Duty of diligence (Financial Instruments and Exchange Act, Article 41 Paragraph 2, Article 42 Paragraph 2)

* You can scroll to the left and right.

| In-house training | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|

| Compliance training | 12 sessions | 12 sessions | 14 sessions |

| Sustainability training | 1 sessions | 1 sessions | 1 sessions |

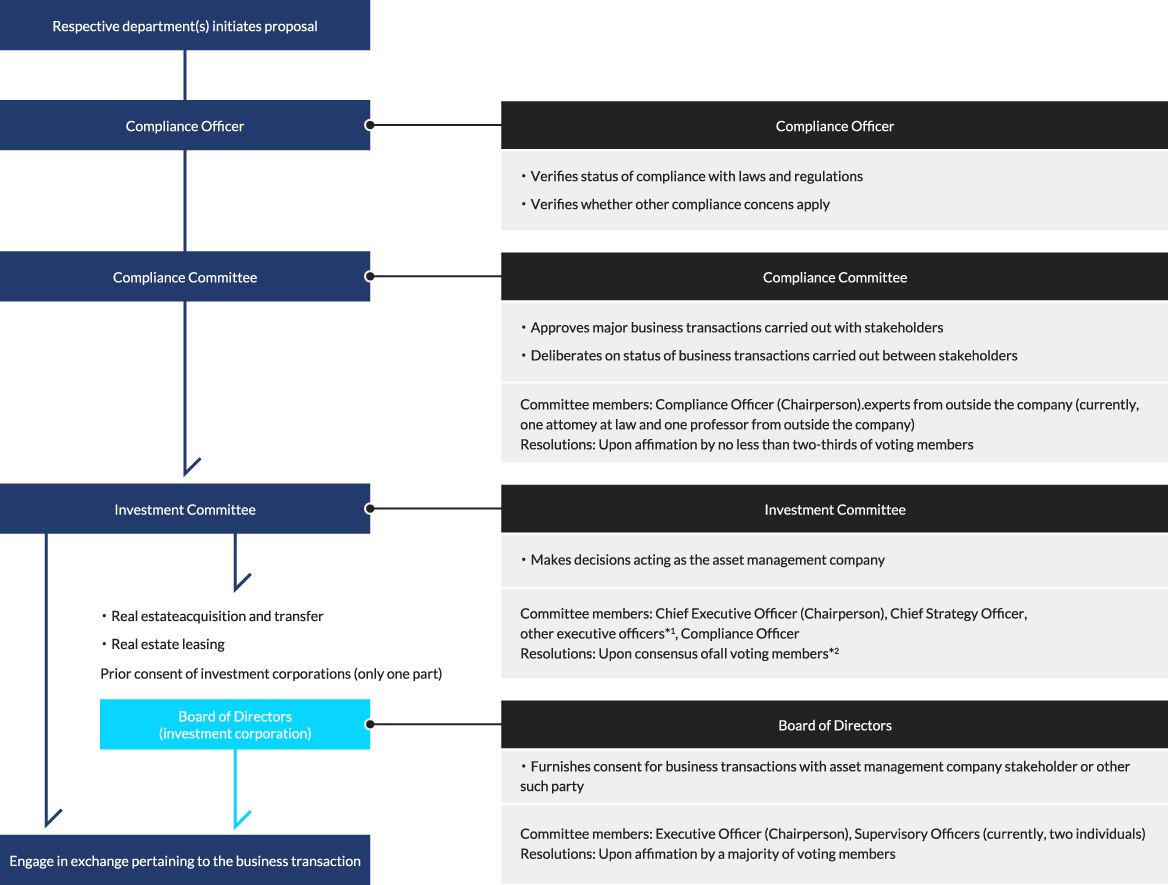

NREAM has established the Investment Committee and the Compliance Committee as part of its framework for appropriately managing conflict-of-interest transactions.

* You can scroll to the left and right.

*1 This does not include the Fund Managers or Executive Officers concurrently serving as general managers of respective departments established within the NMF operations group.

*2 The Compliance Officer and Executive Officers solely responsible for administrative operations do not possess voting rights.

* You can scroll to the left and right.

* Items concerning the acquisition or sale of properties include outsourced cases (PM, mediation, etc.), specifically 16 in FY2022, 14 in FY2023 and 23 in FY2024.

* You can scroll to the left and right.

| Investment Committee | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|

| Number of meetings | 28 | 37 | 44 |

| Number of proposals | 86 total | 94 total | 146 total |

| Acquisition or sale of Properties | 50 proposals | 55 proposals | 86 proposals |

| Borrowing and repayment | 4 proposals | 3 proposals | 6 |

| Repairs and capital expenditure | 2 proposals | 0 proposals | 17 |

| Capital increase | 0 proposals | 0 proposals | 1 proposals |

| Financial results | 7 proposals | 5 proposals | 5 proposals |

| Asset management policy | 16 proposals | 22 proposals | 20 proposals |

| Lease | 2 proposals | 1 proposals | 1 proposals |

| Other | 5 proposals | 8 proposals | 10 proposals |

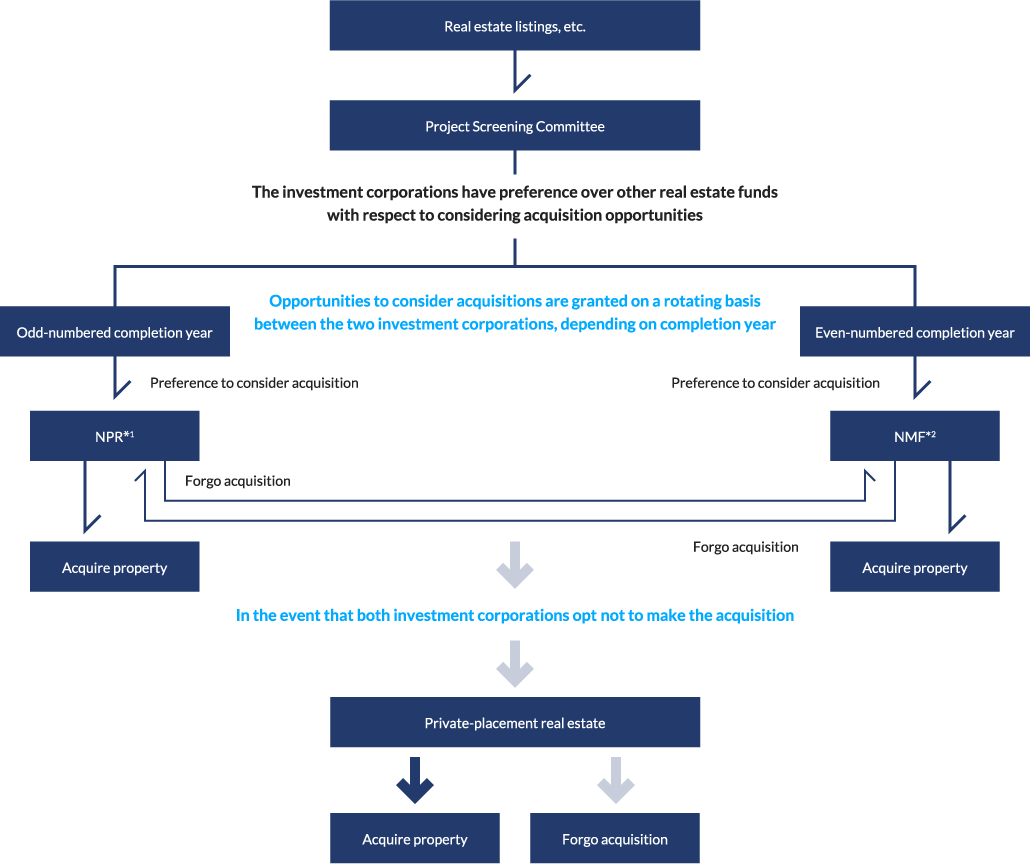

NREAM is entrusted with asset management and investment advisory services for Nomura Real Estate Master Fund, Inc. (NMF), Nomura Real Estate Private REIT, Inc. (NPR), and other real estate funds.

Accordingly, when considering the acquisition of properties based on third-party sales information, NREAM has adopted the Rotation Rule to prevent conflicts of interest among the funds for which it provides management services. Under this rule, NREAM separates the individuals responsible for investment decision-making for each fund and ensures strict information controls, while also implementing a fair rotation of priority consideration opportunities among the funds based on criteria such as the year the property was completed.

Each fund then independently determines whether to acquire or pass on a property in accordance with its respective investment policy.

*1 NPR: Nomura Real Estate Private REIT, Inc. (private-placement REIT)

*2 NMF: Nomura Real Estate Master Fund, Inc. (listed REIT)

■ Clear Communication of Fees and Other Charges

As a consideration for asset management services, NREAM mainly receives acquisition fees, management fees during the fiscal term, and sales fees. However, specific remuneration structures and standards are set for each individual investor or fund based on the contents of transactions, market trading customs, and so on. Below is indicated an outline of the management fee structure in Nomura Real Estate Master Fund, Inc. (NMF), for which NREAM has been entrusted to carry out asset management-related services. Also, concerning the detailed amounts of fees, see this management report, etc. which is published by Nomura Real Estate Master Fund, Inc. (NMF).

In addition, the agreements and management reports distributed to investors clearly specify the fees of other funds (e.g., private REIT and private real estate funds) that are entrusted to NREAM.

* You can scroll to the left and right.

| Fee | Description |

|---|---|

| Management Fee I | The amount obtained by multiplying Total Assets by 0.45% (pro rata monthly amounts shall be calculated on the basis of 12 months in a calendar year; rounding down amounts less than one yen) |

| Management Fee II | The amount obtained by multiplying Net Income Before Deduction of Management Fee II* by 5.5% (rounding down amounts less than one yen)

* Net Income Before Deduction of Management Fee II refers to the amount obtained by adding goodwill amortization cost and deducting gain on negative goodwill from net income before taxes (but before deduction of Management Fee II and non-deductible consumption taxes on Management Fee II), and after compensation of loss carried forward, if any |

| Acquisition Fee | In the event where a specified asset has been acquired, the amount obtained by multiplying the Acquisition Price by 1.0% (maximum)

* 0.5% (maximum) in the event the acquisition is from a related party |

| Sales Fee | In the event where a specified asset has been disposed, the amount obtained by multiplying the Disposition Price (the disposition price in the event of sale, or in the event of an exchange, the sale price stated in the exchange agreement of the asset being disposed of) by 1.0% (maximum)

* 0.5% (maximum) in the event the disposition is to a related party |

*For further details, refer to the Articles of Incorporation of Nomura Real Estate Master Fund, Inc.

NREAM strives to understand investors' needs and, in cooperation with internal and external parties involved in product structuring, develops products and services, and conducts asset management in consideration of those needs.

See here for NREAM's solicitation policy and here for our asset management products.

Our fund website also introduces the characteristics of products. (See here for Nomura Real Estate Master Fund, Inc. and here for Nomura Real Estate Private REIT, Inc.).

Moreover, Nomura Real Estate Master Fund, Inc., which caters to many individual investors, creates settlement materials that highlight key points necessary to individual investors, which can be viewed here.

* Currently, NREAM does not sell or recommend packages comprising multiple financial products and services.

* You can scroll to the left and right.

| Number of press releases | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|

| Total number | 32 total | 29 total | 40 total |

| Acquisition or sale of properties | 4 | 7 | 11 |

| Financial results | 4 | 0 | 1 |

| Borrowing and repayment | 17 | 14 | 19 |

| Capital increase | 0 | 0 | 0 |

| Other | 7 | 8 | 9 |

Note: For further details, refer to the Press Release page of the Nomura Real Estate Master Fund, Inc. website.

* You can scroll to the left and right.

| IR activities | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|

| Earnings briefings | 2 | 2 | 2 |

| IR meetings (Japan) * | 143 companies | 130 companies | 139 companies |

| IR meetings (overseas) * | 53 companies | 61 companies | 87 companies |

| Conferences and seminars for individual investors (Japan) | 0 days | 0 days | 4 days |

| Conferences and seminars for institutional investors (overseas) | 5 days | 6 days | 8 days |

*Includes conference calls

■ Provision of Appropriate Services to Investors

NREAM strives to understand investors' needs and, in cooperation with internal and external parties involved in product and service structuring, develops products and services and conducts asset management with these needs in mind.

See here for NREAM's solicitation policy and here for our asset management products.

Our fund website also introduces the characteristics of products. (See here for Nomura Real Estate Master Fund, Inc. and here for Nomura Real Estate Private REIT, Inc.).

Moreover, Nomura Real Estate Master Fund, Inc., which caters to many individual investors, creates settlement materials highlighting key points for them, which can be viewed here.

* Currently, NREAM does not sell or recommend packages comprising multiple financial products and services.

■ In-company Training

Based on the Compliance Program compiled each business year, NREAM conducts compliance training to improve awareness about the "Compliance Manual" and other related matters.

* You can scroll to the left and right.

| In-house training | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

|---|---|---|---|

| Compliance training | 12 sessions | 12 sessions | 14 sessions |

■ Compensation Structure

At its first General Meeting of Unitholders held on May 26, 2017, Nomura Real Estate Master Fund, Inc. (NMF) resolved to modify its provisions on asset management fees to establish an asset management fee structure that would be better geared to investor interests.

The change took effect from the fiscal period that ended February 28, 2018 (from September 1, 2017, to February 28, 2018).