ABOUT US

Nomura Real Estate Asset Management Co., Ltd. (NREAM) has adopted all the Principles for Customer-Oriented Business Conduct, published by the Financial Services Agency on March 30, 2017 and revised on January 15, 2021. By ensuring fiduciary duty to investors, NREAM aims to be an asset management company that earns and retains the support of all investors.

To ensure fiduciary duty to investors is applied in practice, NREAM will continually monitor progress, and where necessary, review its Policy Regarding Fiduciary Duty to Investors.

As a financial business operator, NREAM will work in the best interests of investors by maintaining the high standards of expertise and ethical behavior and by providing honest and fair advice.

NREAM will also strive to make fiduciary duty an integral part of its corporate culture.

To pursue the best interests of investors in the provision of asset management and other services, NREAM maximizes the expertise and network of the Nomura Real Estate Group. As part of that relationship, NREAM sells and purchases assets, carries out subcontracted business activities and conducts other business transactions with related parties in the Nomura Real Estate Group and other partners, creating the potential for conflicts of interest with investors. Furthermore, NREAM has been entrusted with the management of several investment funds, which also presents the potential for conflicts of interest with investors.

NREAM is well aware of this aspect of its business. Consequently, NREAM will seek to retain the confidence of investors by putting in place systems to prevent transactions involving conflicts of interest and by appropriately managing any potential conflicts of interest.

NREAM will work to disclose more information to provide investors with a better understanding of its products and services, including detailed information regarding commissions and charges such as asset management fees paid by investors, as required by law, and information disclosed voluntarily by the Company.

NREAM has been entrusted to carry out all asset management-related services for Nomura Real Estate Master Fund, Inc. (NMF). Asset management fees received for those services are explained in an easy-to-understand manner on NMF's website.

To ensure investor understanding, NREAM will diligently provide easy-to-understand information about the funds it has been entrusted to manage and other financial products and services.

Important information related to the operation of NMF is disclosed in a timely and understandable manner on NMF's website.

NREAM will endeavor to understand the needs of investors and develop products and services and provide asset management services tailored to those needs.

NREAM is committed to appropriately providing products and services upon considering the risks and complexity of such products and services and the attributes of investors.

※NREAM currently does not sell, recommend or otherwise handle packages of multiple financial products/services.

To ensure employees pursue the best interests of investors and to appropriately manage conflicts of interest, NREAM is raising awareness about compliance and establishing an investment management approach that puts fiduciary duty.

Specifically, in principle, NREAM develops a compliance program each year, and based on that program, implements compliance training and other measures to raise awareness about compliance.

As part of efforts to thoroughly establish a compliance mindset, NREAM has also developed a Compliance Manual for all employees and executives containing concrete advice about how to put compliance into practice.

In entrusted fund management, NREAM strives to conduct asset management that puts even greater emphasis on returns for investors.

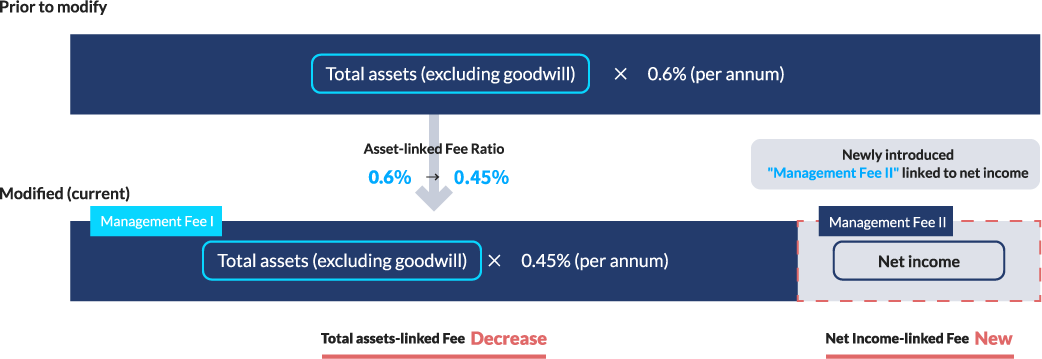

Specifically, NMF revised its asset management fee structure in September 2017, creating a closer link between fees and investor returns. These changes to fee structure are designed to motivate employees to pursue the best interests of investors.

Enacted March 15, 2018

Revised June 24, 2021

■ Corporate Philosophy

See here for details on the NREAM corporate philosophy, "Pursuit of Investor-Oriented Performance."

■ Sustainability

Recognizing that it is essential to consider Environment, Society, and Governance to enhance medium- to long-term value for investors, NREAM has established its basic policy concerning sustainability and is advancing initiatives based on this. See here for NREAM's initiatives related to sustainability.

Also, see here for initiatives related to sustainability in Nomura Real Estate Master Fund, Inc. (NMF), for which NREAM has been entrusted to carry out asset management-related services.

■ High-level Expertise

Officers and employees of NREAM, in principle, comprise personnel loaned from Nomura Real Estate Development Co., Ltd. and include numerous professionals in the real estate field who are endowed with work experience in various departments of the company (such as land acquisition, tenant leasing, development, property management, buying and selling, and mediation). See here for our operating capabilities that are based on NREAM's high-level expertise.

In addition, NREAM encourages all employees (*excluding some officers, contract employees, and assigned employees) to acquire specialist qualifications, such as "Real Estate Transaction Agent" and "Association for Real Estate Securitization Certified Master," as part of its human resources development geared to improving the knowledge and expertise of personnel. NREAM bears the expenses that are incurred in receiving such education, taking examinations, and maintaining qualifications.

* You can scroll to the left and right.

| Professional qualifications | Fiscal 2020 170 executives and employees |

Fiscal 2021 160 executives and employees ※as of July 1, 2021 |

Fiscal 2022 172 executives and employees ※as of July 1, 2022 |

|||

|---|---|---|---|---|---|---|

| Qualification holders * | Percentage | Qualification holders * | Percentage | Qualification holders * | Percentage | |

| Real Estate Transaction Agent | 145 | 85.3% | 133 | 83.1% | 141 | 82.0% |

| ARES Certified Master (ACM) | 116 | 68.2% | 114 | 71.3% | 107 | 62.2% |

| Certified Building Administrator (CBA) | 21 | 12.4% | 22 | 13.8% | 22 | 12.8% |

| Chartered Member of the Securities Analysts Association of Japan (CMA) | 14 | 8.2% | 12 | 7.5% | 8 | 4.7% |

| Real Estate Consulting Master | 6 | 3.5% | 6 | 3.8% | 8 | 4.7% |

| First-class Architect | 7 | 4.1% | 6 | 3.8% | 7 | 4.1% |

| Real Estate Appraiser | 4 | 2.4% | 3 | 1.9% | 3 | 1.7% |

| Licensed Strata Management Consultant | 3 | 1.8% | 1 | 0.6% | 1 | 0.6% |

| Licensed Representative of Condominium Management Company | 2 | 1.2% | 1 | 0.6% | 1 | 0.6% |

| Certified Shopping Center business Administrator (SCBA) | 2 | 1.2% | 1 | 0.6% | 1 | 0.6% |

* Including those who passed the test.

■ High Professional Ethics

NREAM engages in operations with a high standard of professional ethics including the following duties that are required in experts entrusted with real estate-related asset management. Moreover, we seek to penetrate the professional ethics that we adhere to through implementing regular in-company training.

○ Duty of fairness and integrity (Financial Instruments and Exchange Act, Article 36 Paragraph 1)

○ Duty of loyalty (Financial Instruments and Exchange Act, Article 41 Paragraph 1, Article 42 Paragraph 1)

○ Duty of diligence (Financial Instruments and Exchange Act, Article 41 Paragraph 2, Article 42 Paragraph 2)

* You can scroll to the left and right.

| In-house training | Fiscal 2020 | Fiscal 2021 | Fiscal 2022 |

|---|---|---|---|

| Compliance training | 10 sessions | 12 sessions | 12 sessions |

| Sustainability training | 1 sessions | 1 sessions | 1 sessions |

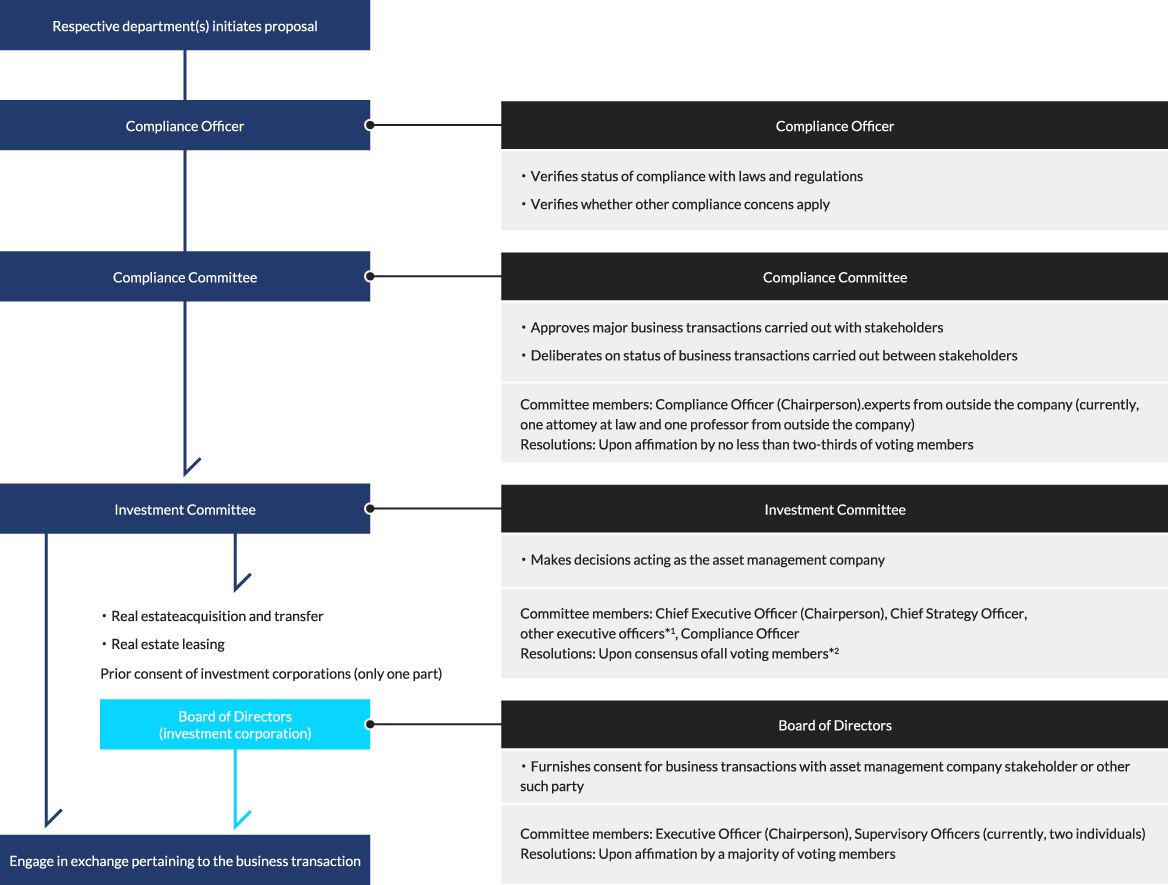

NREAM has established and appropriately manages the Investment Committee and the Compliance Committee, both of which function as part of the framework for preventing conflicts of interest as cited in the Corporate Philosophy.

* You can scroll to the left and right.

*1 This does not include the Fund Managers or Executive Officers concurrently serving as general managers of respective departments established within the NMF operations group.

*2 Voting rights are possessed neither by Compliance Officers nor by Executive Officers in charge of administrative operations.

* You can scroll to the left and right.

* Items concerning the acquisition or sale of properties include outsourced cases (PM, mediation, etc.), specifically 8 in FY2020, 6 in FY2021 and 16 in FY2022.

* You can scroll to the left and right.

| Investment Committee | Fiscal 2020 | Fiscal 2021 | Fiscal 2022 |

|---|---|---|---|

| Number of meetings | 33 | 32 | 28 |

| Number of proposals | 97 total | 80 total | 86 total |

| Acquisition or sale of Properties | 22 proposals | 42 proposals | 50 proposals |

| Borrowing and repayment | 5 proposals | 5 proposals | 4 proposals |

| Repairs and capital expenditure | 2 proposals | 0 proposals | 2 proposals |

| Capital increase | 1 proposals | 1 proposals | 0 proposals |

| Financial results | 15 proposals | 4 proposals | 7 proposals |

| Asset management policy | 21 proposals | 19 proposals | 16 proposals |

| Lease | 23 proposals | 5 proposals | 2 proposals |

| Other | 8 proposals | 4 proposals | 5 proposals |

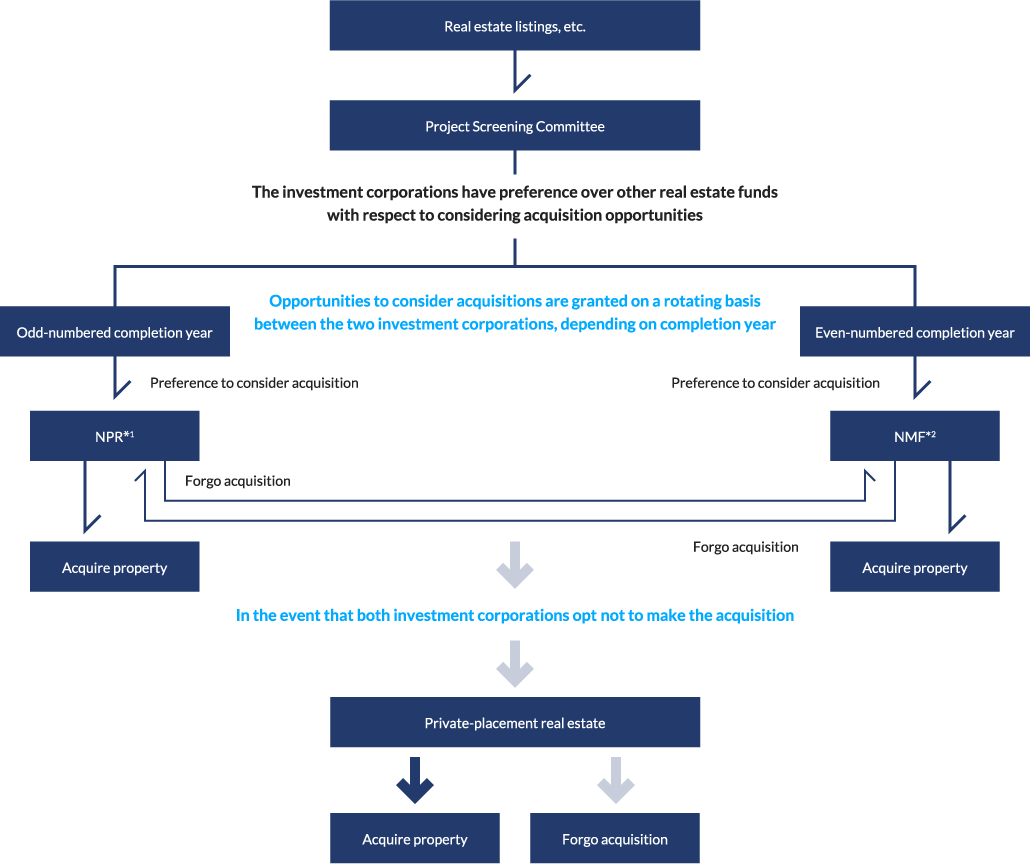

NREAM undertakes business affairs with respect to managing assets and furnishing investment advice primarily to Nomura Real Estate Master Fund, Inc. (NMF), Nomura Real Estate Private REIT, Inc. (NPR) and other real estate funds.

In carrying out such duties, NREAM strives to take preventative action that would avoid the prospect of any conflicts of interest arising among the respective funds for which it manages assets, particularly when considering possibilities of making property acquisitions on the basis of third-party sales information to which it has gained access. To that end, NREAM stringently implements information management practices such that involve ensuring those who make investment decisions for the respective funds handle their duties separately. Meanwhile, NREAM has also adopted the Rotation Rule whereby it ensures that each fund is equitably granted preference to consider acquisition opportunities on a rotating basis particularly depending on the year in which construction was completed with respect to target properties ("completion year").

Moreover, NREAM makes decisions to acquire properties, or otherwise forgo such investment, in accordance with investment policies specific to each of the funds.

*1 NPR: Nomura Real Estate Private REIT, Inc. (private-placement REIT)

*2 NMF: Nomura Real Estate Master Fund, Inc. (listed REIT)

■ Clear Communication of Fees and Other Charges

As a consideration for asset management services, NREAM mainly receives acquisition fees, management fees during the fiscal term, and sales fees. However, specific remuneration structures and standards are set for each individual investor or fund based on the contents of transactions, market trading customs, and so on. Below is indicated an outline of the management fee structure in Nomura Real Estate Master Fund, Inc. (NMF), for which NREAM has been entrusted to carry out asset management-related services. Also, concerning the detailed amounts of fees, see this management report, etc. which is published by Nomura Real Estate Master Fund, Inc. (NMF).

In addition, the agreements and management reports distributed to investors clearly specify the fees of other funds (e.g., private REIT and private real estate funds) that are entrusted to NREAM.

* You can scroll to the left and right.

| Fee | Description |

|---|---|

| Management Fee I | The amount obtained by multiplying Total Assets by 0.45% (pro rata monthly amounts shall be calculated on the basis of 12 months in a calendar year; rounding down amounts less than one yen) |

| Management Fee II | The amount obtained by multiplying Net Income Before Deduction of Management Fee II* by 5.5% (rounding down amounts less than one yen)

* Net Income Before Deduction of Management Fee II refers to the amount obtained by adding goodwill amortization cost and deducting gain on negative goodwill from net income before taxes (but before deduction of Management Fee II and non-deductible consumption taxes on Management Fee II), and after compensation of loss carried forward, if any |

| Acquisition Fee | In the event where a specified asset has been acquired, the amount obtained by multiplying the Acquisition Price by 1.0% (maximum)

* 0.5% (maximum) in the event the acquisition is from a related party |

| Sales Fee | In the event where a specified asset has been disposed, the amount obtained by multiplying the Disposition Price (the disposition price in the event of sale, or in the event of an exchange, the sale price stated in the exchange agreement of the asset being disposed of) by 1.0% (maximum)

* 0.5% (maximum) in the event the disposition is to a related party |

*For further details, refer to the Articles of Incorporation of Nomura Real Estate Master Fund, Inc.

■Provision of Information to Customers

NREAM discloses appropriate and accurate information based on laws and regulations concerning listed REIT (Nomura Real Estate Master Fund, Inc. (NMF)) and non-listed REIT (Nomura Real Estate Private REIT, Inc.); and the websites of investment corporations seek to provide easy-to-understand information concerning the outline contents, investment policies, portfolios, and financial conditions. Moreover, we implement regular and irregular IR activities (including seminars, etc.) to enhance investors' understanding of the investment companies. As an example, the following table shows the number of press releases and IR activities that have been issued and implemented by Nomura Real Estate Master Fund.

And for other private real estate funds, resources of information would be provided by fund product descriptions, information memorandums, and term-separate management reports for investors. And we also strive to provide appropriate and easy-to-understand information according to each investor's trading experience and financial knowledge within our routine relations.

* You can scroll to the left and right.

| Number of press releases | Fiscal 2020 | Fiscal 2021 | Fiscal 2022 |

|---|---|---|---|

| Total number | 32 total | 30 total | 32 total |

| Acquisition or sale of properties | 2 | 4 | 4 |

| Financial results | 2 | 2 | 4 |

| Borrowing and repayment | 17 | 19 | 17 |

| Capital increase | 0 | 0 | 0 |

| Other | 11 | 5 | 7 |

Note: For further details, refer to the Press Release page of the Nomura Real Estate Master Fund, Inc. website.

* You can scroll to the left and right.

| IR activities | Fiscal 2020 | Fiscal 2021 | Fiscal 2022 |

|---|---|---|---|

| Earnings briefings | 0 | 0 | 2 |

| IR meetings (Japan) * | 113 companies | 110 companies | 143 companies |

| IR meetings (overseas) * | 69 companies | 57 companies | 53 companies |

| Conferences and seminars for individual investors (Japan) | 0 days | 0 days | 0 days |

| Conferences and seminars for institutional investors (overseas) | 11 days | 10 days | 5 days |

*Includes conference calls

■ Provision of Appropriate Services to Investors

NREAM strives to grasp the needs of investors so that it can develop products and services and manage assets in consideration of investors' needs. See here for NREAM's solicitation policy, and here for our asset management products.

Our fund website also introduces the characteristics of products. (See here for Nomura Real Estate Master Fund, Inc. and here for Nomura Real Estate Private REIT, Inc.). Moreover, Nomura Real Estate Master Fund, Inc., which caters to many individual investors, creates settlement materials that stress points that are important to individual investors, and these can be viewed here.

※Currently, NREAM does not sell or recommend packages comprising multiple financial products and services.

■ In-company Training

Based on the Compliance Program compiled each business year, NREAM conducts compliance training to improve awareness about the "Compliance Manual" and other related matters.

* You can scroll to the left and right.

| In-house training | Fiscal 2020 | Fiscal 2021 | Fiscal 2022 |

|---|---|---|---|

| Compliance training | 10 sessions | 12 sessions | 12 sessions |

■ Compensation Structure

At its first General Meeting of Unitholders held on May 26, 2017, Nomura Real Estate Master Fund, Inc. (NMF) resolved to modify its provisions on asset management fees to establish an asset management fee structure that would be better geared to investor interests.

The change took effect from the fiscal period that ended February 28, 2018 (from September 1, 2017, to February 28, 2018).