Responsible for the company's strategic planning and handles all human resource, general affairs, investigation, research and product planning and development of new business fields ,matters related to planning, formulation and promotion of digital strategy and corporate accounting matters. Also overseas development and maintenance of information management systems for real estate assets managed by the funds.

Responsible for all matters concerning risk management and compliance. Also oversees the handling of client complaints.

Responsible for evaluating and improving the effectiveness of our governance, risk management and control processes.

Responsible for preparing fiscal financial statements and all aspects of day-to-day accounting for our funds, as well as matters related to loan financing and corporate bond issuances for our J-REITs.

Responsible for sourcing, analyzing, performing due diligence on, and other acquisition related matters related to new real estate investments for our funds.

We handle all matters related to the promotion of ESG initiatives based on our sustainability policy. Also, we are taking care of all matters related to the construction, environment, and engineering of properties held in our funds.

We are in charge of the investigation and analysis of the investment environment in light of the investigation and analysis of macroeconomic trends, real estate market trends, etc.

We focus on investment advisory for investment trusts targeting the investment securities and investment corporation bond certificates of listed investment corporations, and also on matters related to the investigation and research of new business fields and the development and formation of new product plans.

Responsible for planning, conducting market research, and analyzing overseas asset management businesses. Also, overseeing operations related to business alliances with overseas asset management companies, capital alliances, investment management of overseas financial funds, and providing investment advice.

Responsible for asset management and investment advisory regarding private funds, etc. (not including overseas financial product funds; the same applies below). Responsible for the formation of private funds, etc. and matters related to the signing of structure-related contracts.

Responsible for the investment management and funding through new unit issuances of Nomura Real Estate Master Fund, including all matters related to disclosures, investor relations and unitholder meetings.

Responsible for the investment management and funding through new unit issuances of Nomura Real Estate Private Fund, including all matters related to disclosures, investor relations and unitholder meetings.

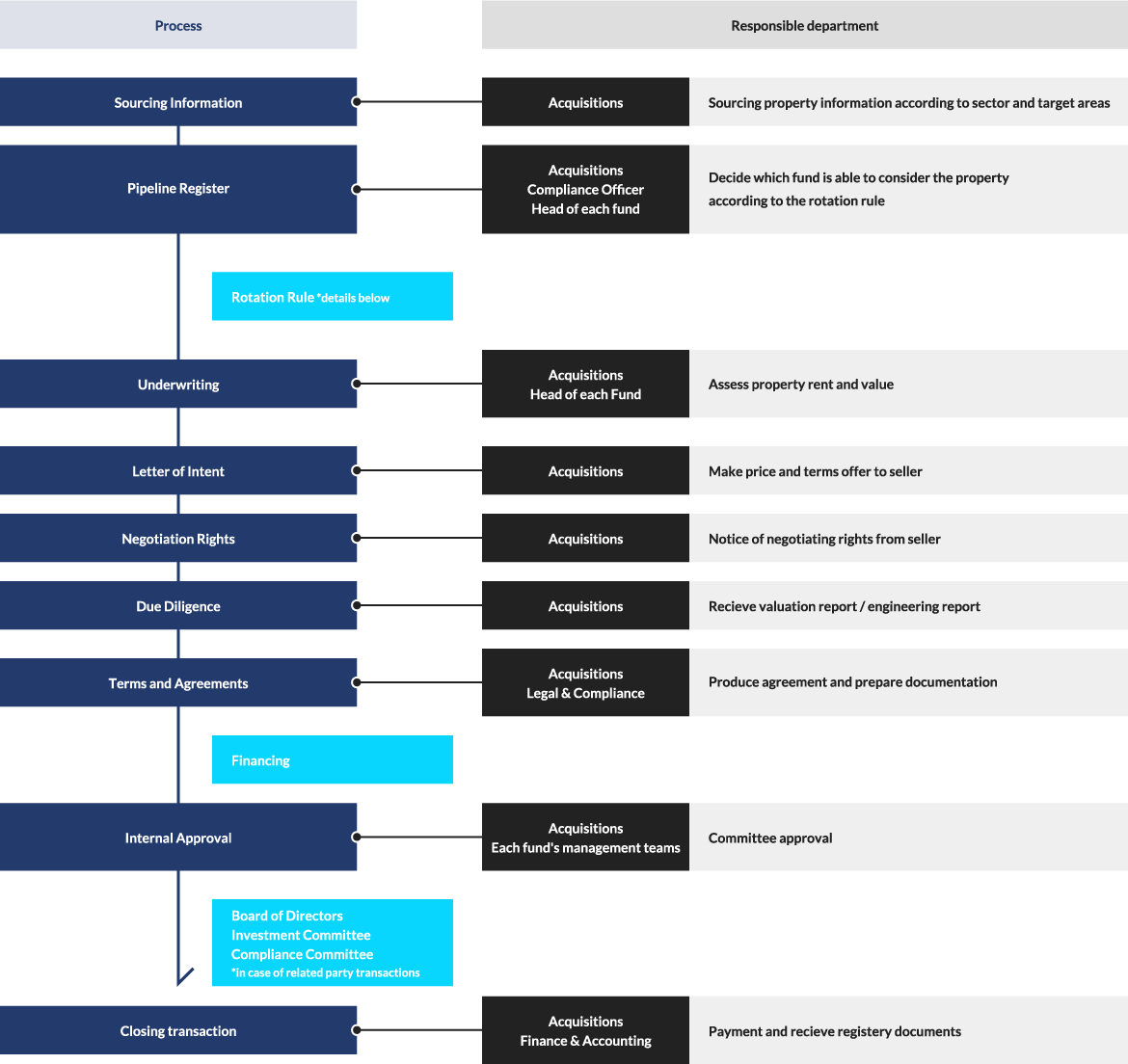

Our approach to real estate investment follows a strict decision making process.

* You can scroll to the left and right.

| Investment Committee | |

|---|---|

| Chairperson |

|

| Committee Members |

|

| Non-voting committee members |

|

| Resolutions |

|

| Requirements to Pass Resolution | Unanimous vote of all committee members who have voting rights |

| Frequency |

|

*1 Excludes Executive Officers and part-time Executive Officers who are also the head of a fund or a General Manager of a department within the NMF Management Group

*2 Including when the Compliance Officer is also an Executive Officer

*3 Including when they are also the overseeing Executive Offer or General Managers

*4 Coporate Planning, Complaince and Internal Audit departments

* You can scroll to the left and right.

| Compliance Committee | |

|---|---|

| Chairperson |

|

| Committee Members |

|

| Non-voting committee members | Compliance committee members who are related parties or are either Executive Directors or employees of companies that are related parties do not have voting rights. This does not apply to the Compliance Officer. |

| Resolutions |

|

| Requirements to Pass Resolution | two-thirds (2/3) or more of the votes of all committee members who have voting rights. |

| Frequency | In general, once every three months when the Committee Chariman calls a meeting, or anytime when necessary. |

* You can scroll to the left and right.

| Risk Management Committee | |

|---|---|

| Chairperson |

|

| Committee Members |

|

| Resolutions | Prepare and amend the risk management annual plan* |

| Requirements to Pass Resolution | two-thirds (2/3) or more of the votes of all committee members who have voting rights. |

| Frequency | At least once every three months when the Committee Chairman calls a meeting, or anytime when necessary. |

*Identifying additional risk items which need to be included for each department, and the measures and timeline for each

NREAM undertakes business affairs with respect to managing assets and furnishing investment advice primarily to Nomura Real Estate Master Fund, Inc. (NMF), Nomura Real Estate Private REIT, Inc. (NPR) and other real estate funds.

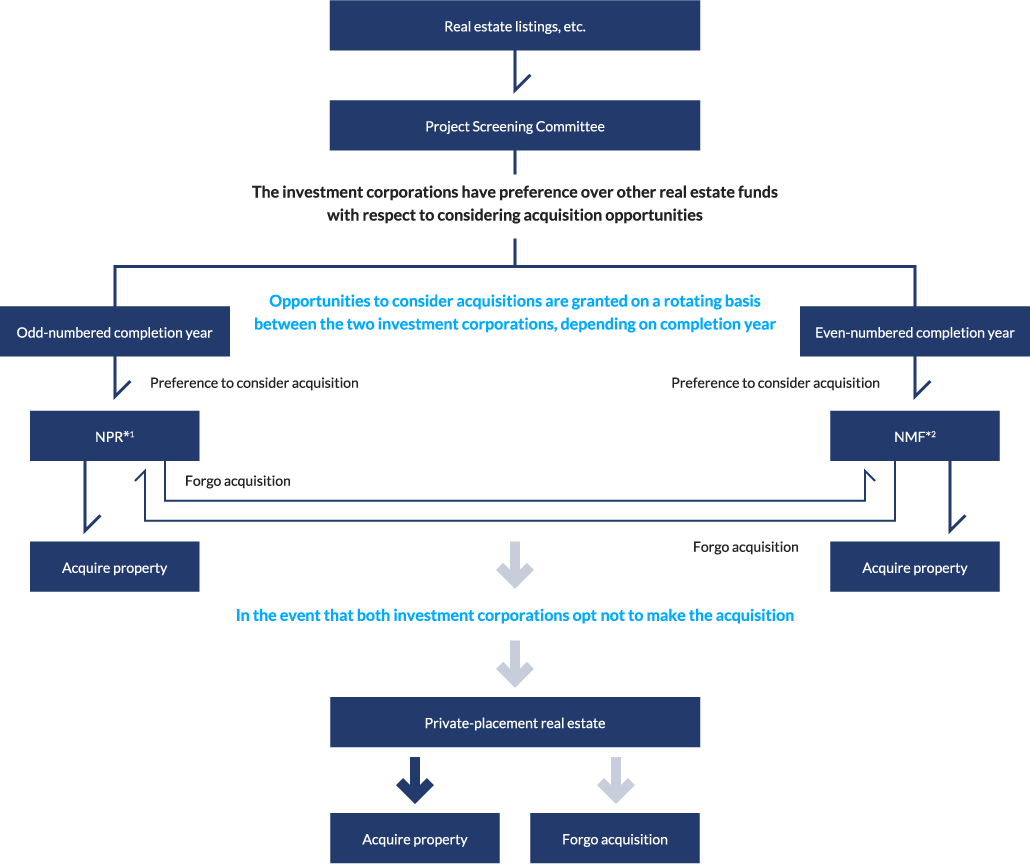

In carrying out such duties, NREAM strives to take preventative action that would avoid the prospect of any conflicts of interest arising among the respective funds for which it manages assets, particularly when considering possibilities of making property acquisitions on the basis of third-party sales information to which it has gained access. To that end, NREAM stringently implements information management practices such that involve ensuring those who make investment decisions for the respective funds handle their duties separately. Meanwhile, NREAM has also adopted the Rotation Rule whereby it ensures that each fund is equitably granted preference to consider acquisition opportunities on a rotating basis particularly depending on the year in which construction was completed with respect to target properties ("completion year").

Moreover, NREAM makes decisions to acquire properties, or otherwise forgo such investment, in accordance with investment policies specific to each of the funds.

*1 NPR: Nomura Real Estate Private REIT, Inc. (private-placement REIT)

*2 NMF: Nomura Real Estate Master Fund, Inc. (listed REIT)